Arch Indices Weekly Thoughts: December 26, 2023 |

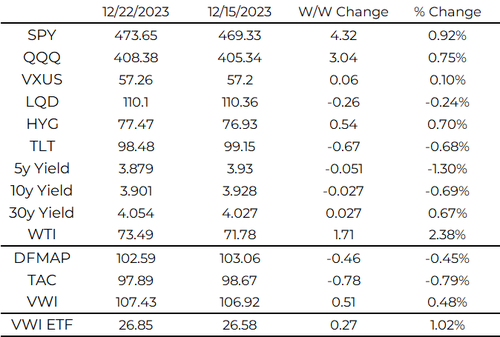

Recapping our current income portfolios:

DFMAP (Dividend Focused Multi-Asset Portfolio)

TAC (Treasuries Across the Curve)

VWI (Volatility Weighted Income)

Please reach out if you would like to learn more about them.

This is our last Weekly of the year. 2023 was an exciting and productive year for Arch Indices. Dr. K and I started January with ideas, some basic code, and a Wikipedia-level knowledge of how to start an ETF. We are ending December with almost 3 months of ETF track record, a cloud-based platform, and an exciting roadmap for 2024.

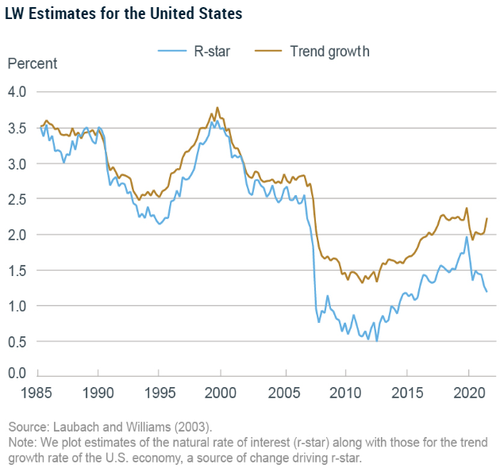

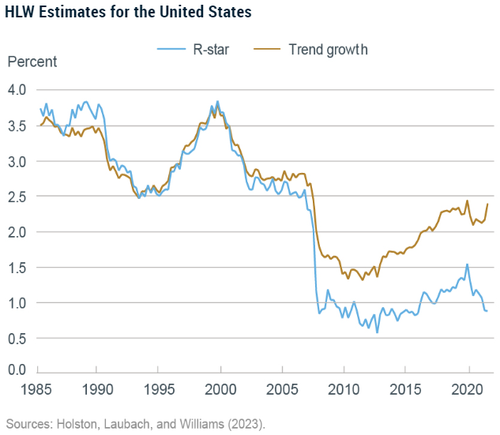

If you were on the FOMC and fully bought into PCE hitting 2%, a soft landing, and pre-emptive rate cuts, what would be your academic “north star”? Luckily there are the r* models the Fed developed for this exact question.

R* is defined as the natural rate of real interest. It is the real short-term interest rate expected when the economy is at full strength and inflation is stable.

The NY Fed publishes two models but they are closely related. Both are based on economic data and suggest a r* around 1% (The NY Fed website has a very detailed explanation). If inflation becomes stable around the 2% target, that would imply a Fed Funds rate of 3% as the neutral rate.

Keep in mind this is largely an academic exercise the same way “term premium” is an academic exercise.

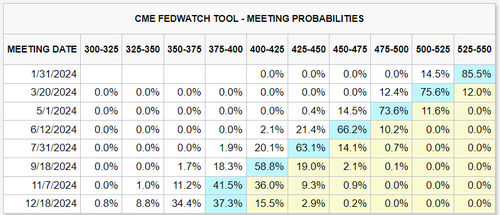

From the looks of it, the Fed is likely to lay the groundwork for a cut sometime around the summer and go from there. Currently there are 4 rate cuts priced into the July31 meeting which gets you about halfway to the 3% neutral rate.

Happy Holidays and Best Wishes for the New Year! 2024 will be an exciting year all around.

| As always your thoughts and feedback are very much appreciated! |