Does this CPI Print Really Matter? |

Our current income portfolios:

DFMAP (Dividend Focused Multi-Asset Portfolio)

TAC (Treasuries Across the Curve)

VWI (Volatility Weighted Income)

Please reach out if you would like to learn more about them.

Shelter is not just causing headaches for Americans due to supply/demand imbalance, it’s causing headaches for the Fed too. A key part of the Fed’s thesis on inflation and rate cuts was the shelter component would be driving core inflation down to 2%.

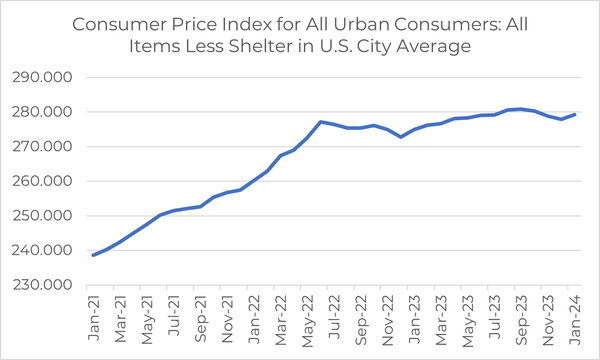

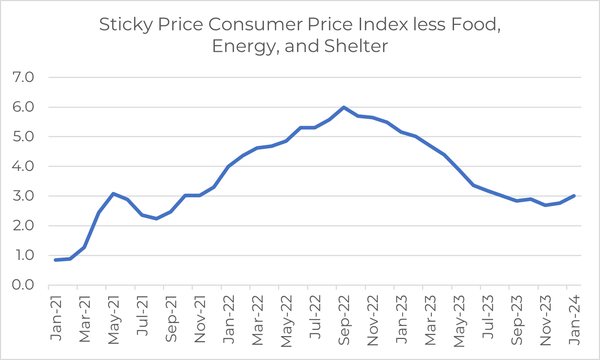

Three key points: 1) this is a survey on owner’s equivalent rent and it was always expected to have a lag, 2) inflation ex-shelter is under 2% y/y (1.55% to be precise), and 3) shelter is half the weight in PCE (which the Fed cares about) relative to CPI.

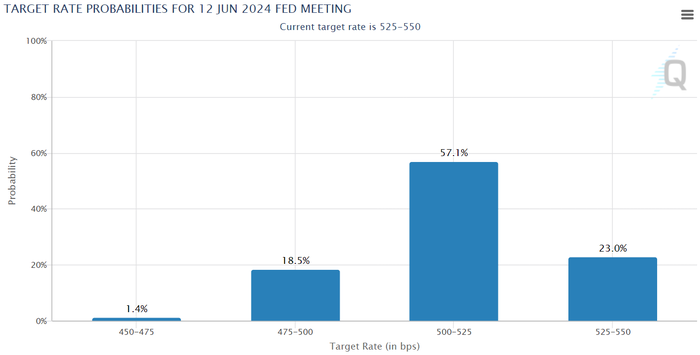

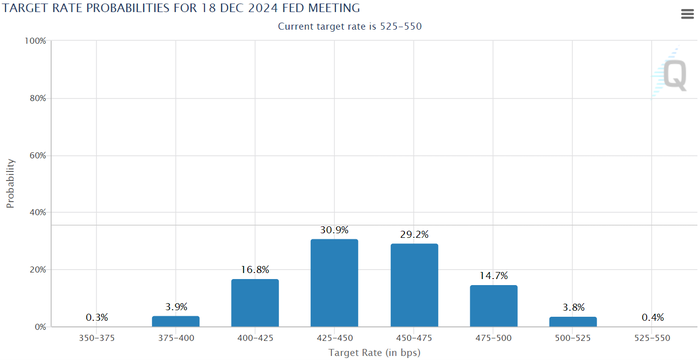

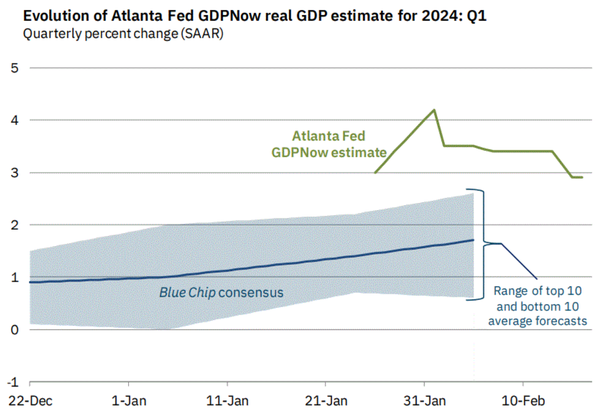

The market reaction Tuesday was more reflective of the recent positioning and chasing of equities. Front-end expectations are now for 3.5 cuts for this year and the first rate cut has been pushed out to June. This seems more in-line with reality given seven cuts was overly optimistic by nearly every measure.

Does this inflation print really matter? Unlikely given the downward path of inflation at the moment and the Fed’s preferred measure of PCE relative to CPI. It’s healthy for markets to re-adjust to reality after a euphoric run-up.

We have a busy media schedule in the coming weeks. This week we were on the Smart Money Circle with Adam Sarham to discuss our background, Arch Indices, and share our timeless advice for risk management: https://www.youtube.com/watch?v=W5VgVLi3Hb8

| As always your thoughts and feedback are very much appreciated! |