Arch Indices Weekly Thoughts: January 16, 2024 |

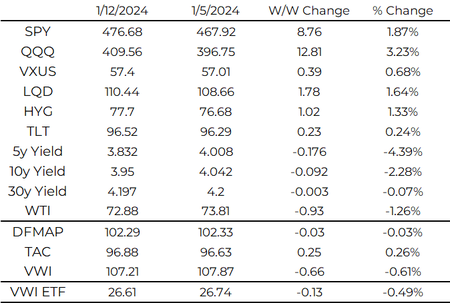

Recapping our current income portfolios:

DFMAP (Dividend Focused Multi-Asset Portfolio)

TAC (Treasuries Across the Curve)

VWI (Volatility Weighted Income)

Please reach out if you would like to learn more about them.

An exciting week in the ETF world with the arrival of Spot Bitcoin ETFs and record launch volumes. ETFs are a great wrapper for investors with transparency, tax efficiency, and intra-day liquidity. Investors benefit tremendously from access to new strategies in ETF wrapper (like our VWI Income Index).

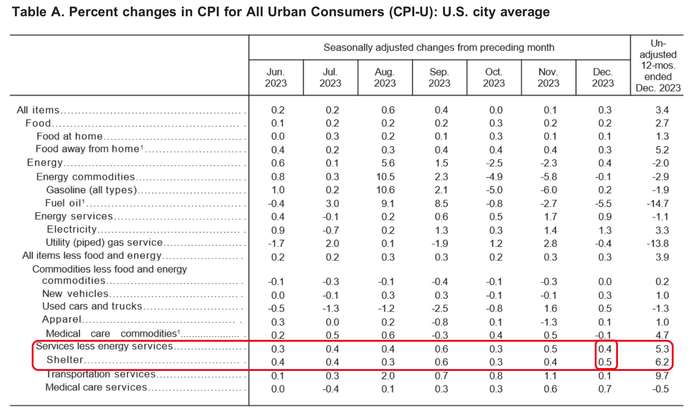

While we were all glued to the Bitcoin ETF launches, CPI came in hotter than expected. The culprit is housing inflation which picked up month/month. This is a worrying data point for the Fed thesis that shelter will drive core inflation down to target and give them room to cut rates in a soft landing. Several real estate economists think this was driven by lag in rent surveys showing up in the official data. Note: Shelter weight in PCE is half of CPI so will be less impactful for the PCE report.

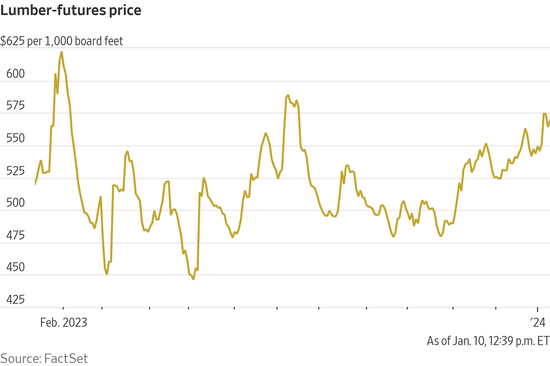

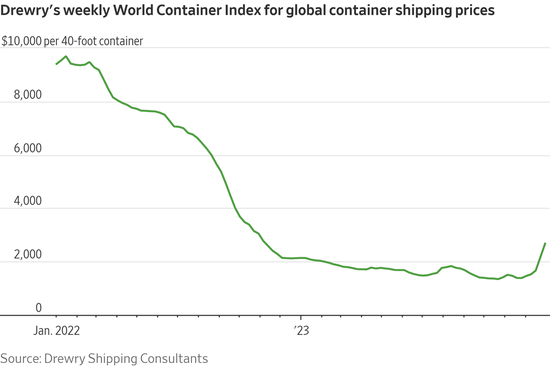

If this is not the case, the 7 rate cuts priced in this year looks even more unlikely with the strong economic data at the moment. We note lumber-futures prices have ticked up almost 10% as mortgage rates decreased over the last month and half and shipping costs are increasing with tensions in the Red Sea.

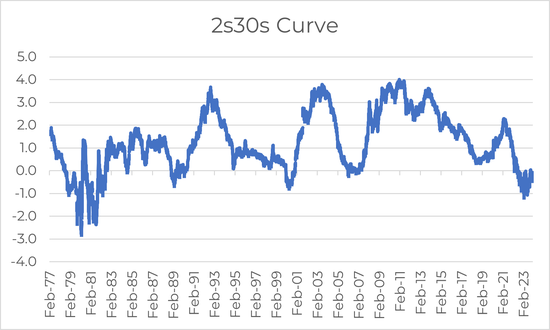

2s30s in the bond market is near positive again after almost 1.5 years of curve inversion. This adds to the view that the “landing” is not far away and likely in the fall.

A steep 2s30s curve makes income investing more interesting and changes the "T-Bill and Chill" appeal for many investors.

| As always your thoughts and feedback are very much appreciated! |