Stocks and Bonds De-Correlating? |

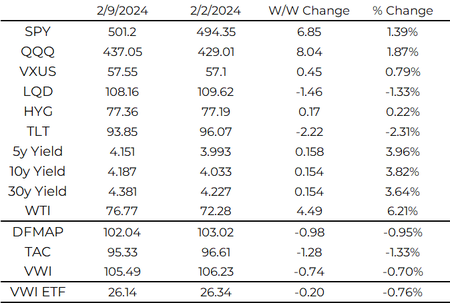

Our current income portfolios:

DFMAP (Dividend Focused Multi-Asset Portfolio)

TAC (Treasuries Across the Curve)

VWI (Volatility Weighted Income)

Please reach out if you would like to learn more about them.

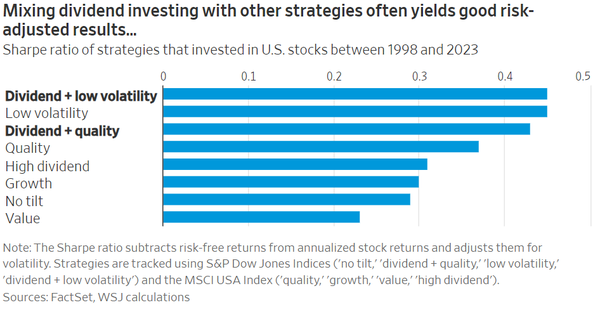

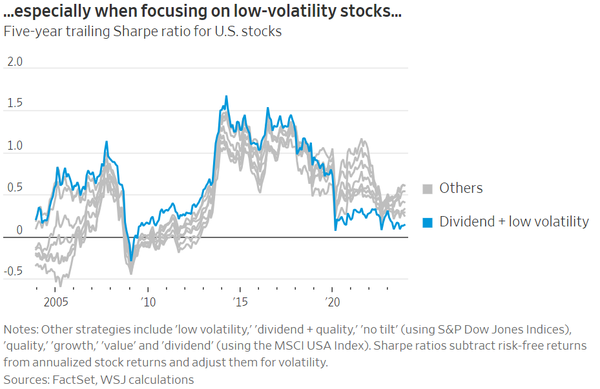

We were quoted in the WSJ about our VWI ETF on Friday (Link). The highlight of combining factors is near and dear to us: our approach is to generate income while minimizing portfolio volatility. The 0 rate environment and quantitative easing from 2009 to 2021 has conditioned investors to emphasize yield over risk-adjusted returns. That era is clearly over and it is time to re-think, combine, and optimize factors in portfolio construction.

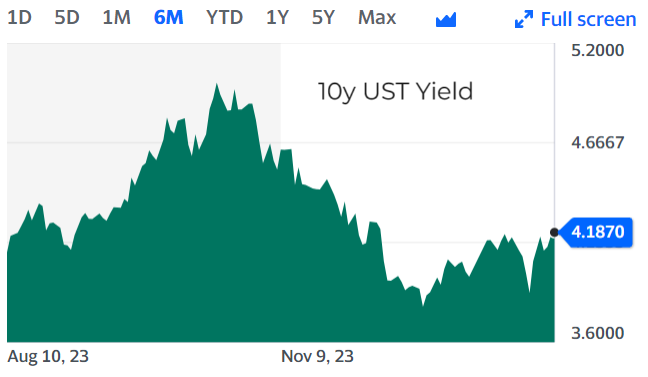

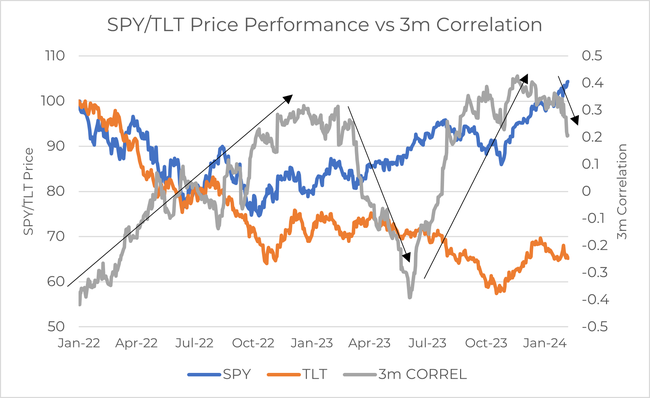

The first six weeks of 2024 have been tough for income investors as the market re-prices Fed cuts (currently ~4.5 in 24), the US economy shows no signs of slowing, and sentiment continues in growth names. The 10y yield has retraced 40bps of the 120bps rally from the yield peak in October to the end of December.

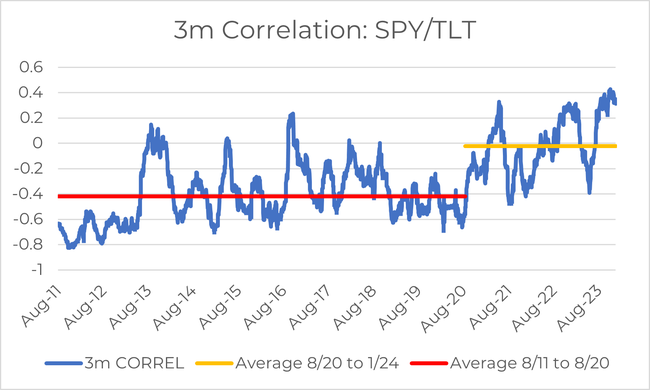

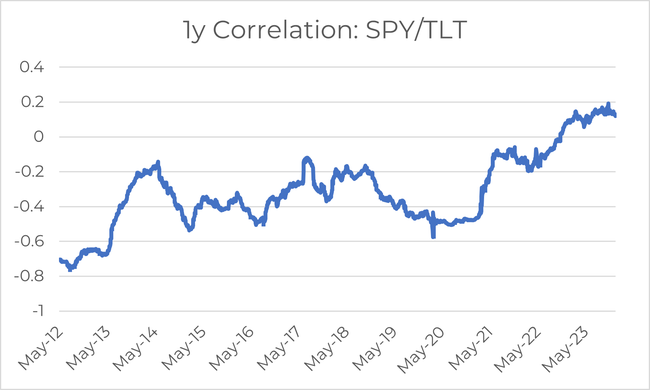

During the QE era, correlation between large-cap stocks and 30y bonds (SPY/TLT) was negative. The Fed targeted loose financial conditions and investors could count on duration being an effective balance to risk assets. This also masked some of the issues of conventional portfolio construction processes.

Since COVID, the Fed has been “navigating by the stars under cloudy skies.” To say the least, the Fed has little confidence in policy and where the economy is headed. We have seen abrupt shifts in Fed action and messaging as they prioritized getting inflation under control. This has led to a breakdown in correlation as interest rates increased and investors reacted to the impact of Fed tightening on the real economy and risk assets.

The major correlation shifts over last two years can be summarized as:

1) 2022: High and increasing correlation: higher rates impact both stocks and bonds; investors question equity valuations in new rate environment

2) 2023 1H: Negative correlation: Fed tightens further (emergency rate hikes) but economic resilence supports risk assets; regional banks fail: bonds rally, stocks fall

3) 2023 2H: High correlation: higher-for-longer impacts both stocks and bonds followed by Fed pivot lifting both stocks and bonds

4) 2024 YTD: Negative and decreasing correlation: stocks march higher with strong economic data and tech earnings as investors question number of rate cuts

Interest rates mean revert over time. The higher yields from the recent retracement provides investors with incremental income and multi-asset diversification benefits as correlation decreases.

| Happy Lunar New Year! Best wishes for health, wealth, and happiness in the Year of the Dragon! |