"Check Yourself"- Jerome Powell |

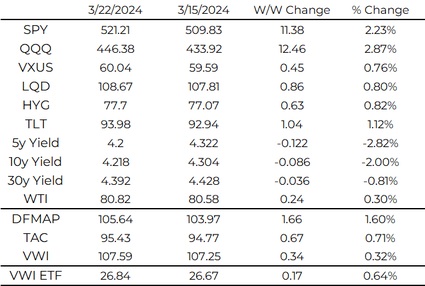

Our current income portfolios:

DFMAP (Dividend Focused Multi-Asset Portfolio)

TAC (Treasuries Across the Curve)

VWI (Volatility Weighted Income)

“Check Yourself” may be one of the most memorable lines spoken in a Fed press conference. Chair Powell was discussing the two hot inflation prints of January and February and emphasizing not dismissing unpleasant data points. He is of the view that January was seasonal in inflation calculation (every January the seasonal adjustments in inflation are re-calculated) and while February was above expectations, core PCE does not look that high.

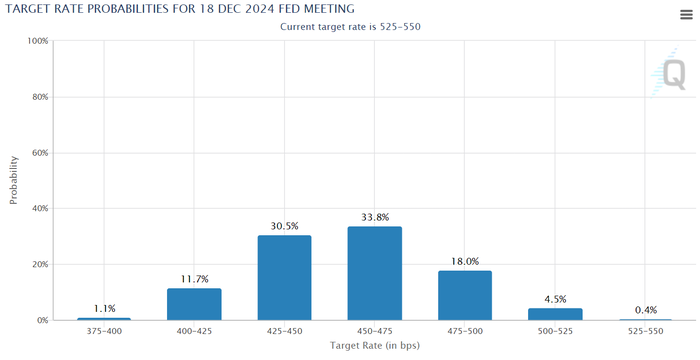

The Fed laid out their thinking with two Timiraos articles Sunday and Monday and appears quite confident that inflation is almost under control and real rates would be overly restrictive. We have little doubt the Fed will cut this year, the only question is will it be twice or thrice and when.

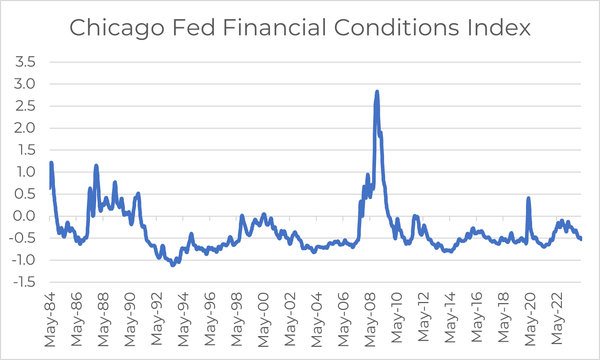

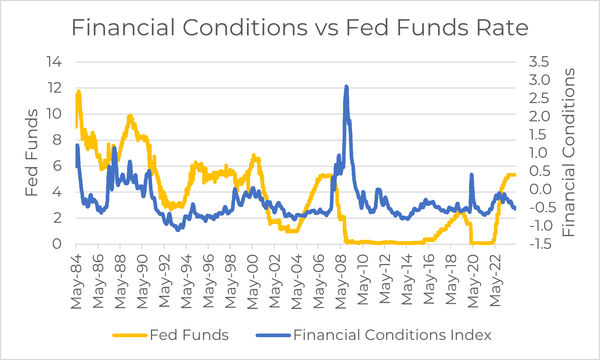

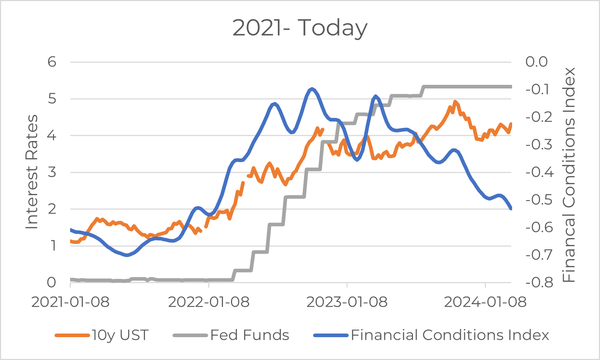

This would be a good time for the Fed to also “check” on financial conditions. Despite a record hiking cycle last two years along with quantitative tightening, financial conditions are back to near record “loose” conditions as the real economy and risk appetite remains healthy. The Financial Conditions Index is a composite of money market, credit market, banking, and equity market indicators.

This is a unique period where the Fed has been able to loosen financial conditions without cutting the Fed Funds rate, engaging in quantitative easing, and where long-term Treasuries yields increased.

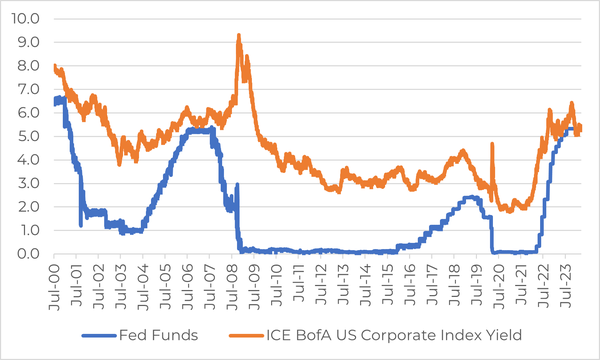

No chart shows the dilemma facing investors in this market better than the one below. The curve inversion and tight credit spreads leaves IG Corporates and short-dated T-bills with similar absolute yields. With loose financial conditions, frothy risk markets, and absolute yield levels, it is a challenging environment to put capital to work.

Yet the ability of the Fed being able to cut many more times if the real economy weakens or financial conditions tighten remains powerful in the minds of investors (the Fed "put").

| As always your thoughts and feedback are very much appreciated! |