Is 5 Cuts the Right Number? |

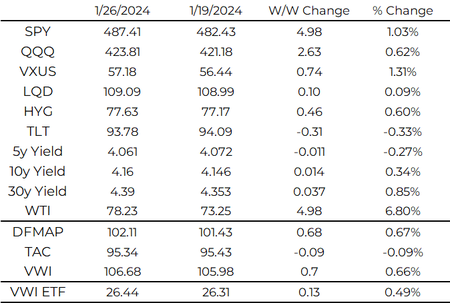

Recapping our current income portfolios:

DFMAP (Dividend Focused Multi-Asset Portfolio)

TAC (Treasuries Across the Curve)

VWI (Volatility Weighted Income) *Note VWI ETF ex-dividend of 0.076/sh

Please reach out if you would like to learn more about them.

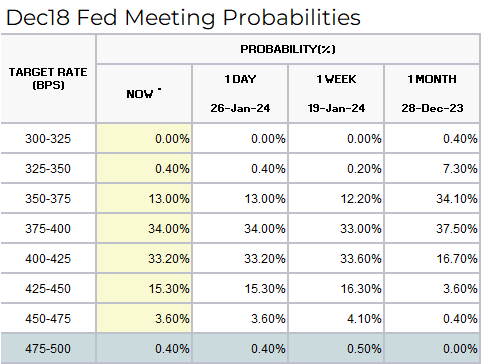

The Fed has their work cut out for them: lowering rates as the economy strengthens. The rate cut equilibrium swung from 7 to 5 cuts for 2024 to start the year and pushed the odds of a March cut to 50/50. Equity investors don’t seem bothered as this was driven by strong economic data while income investors dealt with a 40bps sell-off in 30-year Treasuries.

On cue, the Timiraos preview is out this morning highlighting the issue of estimating the r* neutral rate to guide rates. This “implies rates are highly restrictive, the economy hasn’t behaved that way.” (WSJ Article Link)

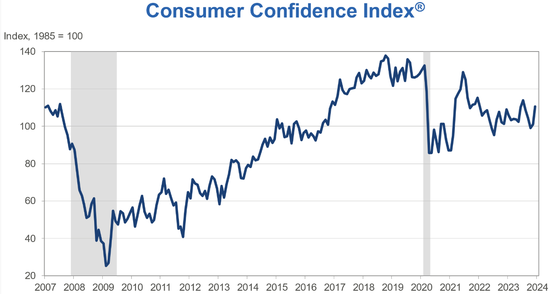

There’s been a sharp and broad-based increase in LEIs recently. A big driver of weak consumer confidence in 2023 was the cost of housing (mortgage rates) and durable goods from the Fed hikes. The consumer is enjoying the Fed pivot in conjunction with a strong labor market.

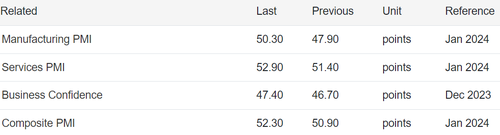

Both manufacturing and services PMIs picked up in January and manufacturing PMI notably swung above 50. (50 is the expansion/contraction point in PMI surveys.)

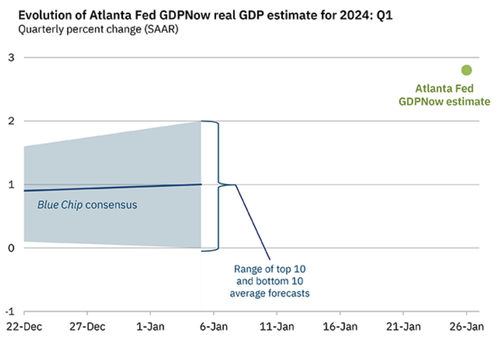

The GDPNow estimate for Q1 is close to 3%: a sharp increase from the 1% expectations a couple of months back.

With mortgage rates dropping over the last two months and both business and consumer confidence picking up:

1) Can the Fed rely solely on declining inflation and r* neutral rate to cut rates throughout the year?

2) Will the Fed need to turn more hawkish to keep inflation on the downward path?

| As always your thoughts and feedback are very much appreciated! |